Get the free ri 20 97 form

Show details

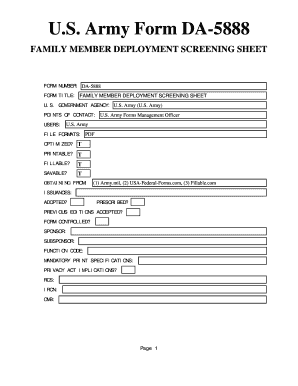

ESTIMATED EARNINGS DURING MILITARY SERVICE INSTRUCTIONS: SUBMIT THIS FORM TO THE APPROPRIATE MILITARY FINANCE CENTER FOR YOUR BRANCH OF MILITARY SERVICE. IF YOU HAVE SERVICE IN MORE THAN ONE BRANCH

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your ri 20 97 form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your ri 20 97 form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit ri 20 97 online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit ri 20 97 example form. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to work with documents.

How to fill out ri 20 97 form

How to fill out a RI 20 97:

01

Start by obtaining the RI 20 97 form from your employer, insurance company, or the relevant government office.

02

Carefully read the instructions provided on the form to understand the information and documents required to complete it accurately.

03

Begin by filling out your personal information, including your name, address, Social Security number, and date of birth.

04

Provide details about your current employment status, such as the name and address of your employer, your job title, and the dates of your employment.

05

Clearly indicate whether you are applying for regular retirement benefits, survivor benefits, or disability benefits.

06

If you are applying for survivor benefits, include the necessary information about the deceased individual, such as their name, Social Security number, and relationship to you.

07

Determine the specific periods for which you are requesting retirement benefits, indicating the starting and ending dates accurately.

08

If applicable, provide information about any previous pensions received or your eligibility for other government benefits.

09

Double-check all the information provided to ensure accuracy and completeness.

10

Sign and date the form in the designated areas before submitting it as instructed.

Who needs a RI 20 97:

01

Individuals who are approaching retirement age and wish to apply for retirement benefits from the Social Security Administration.

02

Individuals who have experienced the loss of a spouse or family member and want to apply for survivor benefits.

03

Individuals who have become disabled and qualify for disability benefits from the government.

Fill how to fill out ri 20 97 : Try Risk Free

People Also Ask about ri 20 97

How do I calculate my military buyback?

What is a RI 20-97?

Where do I send my RI 20-97?

What form do I need to buy back military time?

How do I buy back my military time for federal retirement?

What is a form RI 20-97?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is ri 20 97?

"RI 20 97" may refer to multiple things, so without further context, it is difficult to determine its exact meaning. It could be a code or abbreviation used in a specific industry or organization.

Who is required to file ri 20 97?

RI 20-97 is a form used by individuals who are applying for the voluntary tax withholding program for their Rhode Island retirement benefits. Therefore, individuals who wish to participate in the program and have Rhode Island retirement benefits may be required to file RI 20-97. However, it is always advisable to consult with a tax professional or the Rhode Island Department of Revenue for specific filing requirements.

How to fill out ri 20 97?

RI 20 97 is a form used by the Social Security Administration (SSA) to gather information about an individual's earnings and work activity to determine eligibility for disability benefits. Here are the steps to fill out RI 20 97:

1. Obtain the form: You can download and print RI 20 97 from the SSA website or request a copy from your local SSA office.

2. Personal information: Fill in your personal information at the top of the form, including your full name, Social Security number, address, and contact information.

3. Section 1: This section asks for information about the type of benefits you are applying for. Check the appropriate boxes based on your situation, such as Disability Insurance Benefits (DIB), Disabled Widow(er)'s or Widower's Benefits (DWB), or Disabled Adult Child (DAC) Benefits.

4. Section 2: This section gathers information about your current employment or self-employment. Provide details about your occupation, the last date you worked, and your employer's name and address.

5. Section 3: Here, you will provide information on your medical condition and the limitations it imposes on your ability to work. Give a detailed explanation of your impairments, medical treatments, and any medical professionals you have seen.

6. Section 4: If you currently receive or have received workers' compensation benefits or other benefits related to your disability, provide the requested information in this section.

7. Section 5: This section is for providing details about your earnings for the year in which you became unable to work due to your medical condition. Fill in the information about your gross monthly earnings, the type of work performed, and the name of the employer.

8. Signature: Sign and date the form to certify the accuracy of the information provided.

Make sure to review the completed form for any omissions or errors before submitting it to the SSA. Retain a copy of the form for your records. It's always advisable to consult with an SSA representative or an attorney for guidance when completing this form, especially if there are complex issues involved.

What is the purpose of ri 20 97?

RI 20 97 refers to a code or term that is not widely recognized or associated with any specific purpose. Without further context or clarification, it is not possible to determine the exact purpose of RI 20 97.

What information must be reported on ri 20 97?

RI 20-97 is a form used by the United States Department of Labor to report employment and earnings information of individuals who are receiving benefits under the Federal Employees' Compensation Act (FECA). The specific information that needs to be reported on this form includes:

1. Employee Information: The form requires the employee's name, social security number, date of birth, sex, address, and telephone number.

2. Employment Information: Details of the employee's current employment must be provided, including the job title, employing agency, office location, and supervisor's name.

3. Employment Status: The form asks for information regarding marital status, number of dependents, and the type of employment (full-time, part-time, temporary, or seasonal).

4. Compensation Information: Specifics about the employee's earnings need to be reported, including gross wages, the frequency of payment (weekly, bi-weekly, monthly, etc.), and other sources of income if applicable.

5. Injury/Payment Information: Details about the employee's injury or illness that led to the need for FECA benefits should be provided. This includes the date of the injury, a description of the injury, and information about any existing compensation payments.

6. Insurance Information: Any information about additional insurance coverage the employee may have, such as private health insurance or workers' compensation coverage, must be reported.

7. Medical Treatment: Information about the employee's medical treatment related to the injury, including the names and addresses of healthcare providers and the dates of treatment, should be included.

8. Return to Work: If the employee has returned to work, the form requires details about the return-to-work date, the job title, and any job modifications or restrictions.

9. Signature and Date: The form must be signed and dated by the employee or their authorized representative.

It is important to note that this information may vary depending on the version and specific requirements of the RI 20-97 form in use.

How can I send ri 20 97 to be eSigned by others?

Once your ri 20 97 example form is complete, you can securely share it with recipients and gather eSignatures with pdfFiller in just a few clicks. You may transmit a PDF by email, text message, fax, USPS mail, or online notarization directly from your account. Make an account right now and give it a go.

How do I edit ri 20 97 block 5 in Chrome?

Adding the pdfFiller Google Chrome Extension to your web browser will allow you to start editing ri20 97 and other documents right away when you search for them on a Google page. People who use Chrome can use the service to make changes to their files while they are on the Chrome browser. pdfFiller lets you make fillable documents and make changes to existing PDFs from any internet-connected device.

How do I fill out ri2097 using my mobile device?

Use the pdfFiller mobile app to fill out and sign ri 20 97 form. Visit our website (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, their features, and how to get started.

Fill out your ri 20 97 form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Ri 20 97 Block 5 is not the form you're looking for?Search for another form here.

Keywords relevant to ri 2097 form

Related to form ri 20 97

If you believe that this page should be taken down, please follow our DMCA take down process

here

.